The truth about affordability and our current real estate market.

Today, we’re going to talk about what’s happening in the media and what we’re seeing on the news. A lot of people have been asking questions, and there are a few important things we need to clear up.

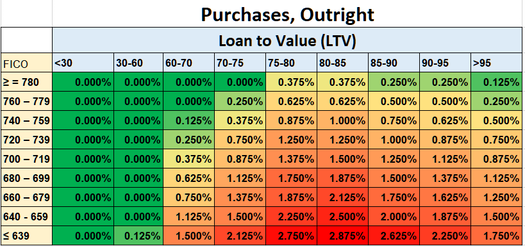

One of the biggest media misconceptions right now is about what Freddie Mac and Fannie Mae just passed about loan level price adjustments (LLPAs). The media is painting the picture that you’ll get a worse interest rate if you have a good credit score, which is completely false. Do not purposely tank your credit score if you plan on purchasing a home this year. If you have a good credit score, you’re still getting a better interest rate than someone who has a lower one.

The change for people with higher credit scores was pretty small, but the significant change that happened is affecting those with a lower score, as they are going to be able to afford more now. This impact on affordability was very needed in today’s market, so don’t stress.

Instead of worrying about what the media says, here are the facts to show you the truth:

As you can see, if you have a score of 640, you’ll be paying significantly more than if you had a score of 740. Using an 80% loan-to-value ratio as an example, your LLPA at 640 is 2.25% versus 0.875% for a 740 score. That’s a 1.375% difference, which is just over $4,000 on a $300,000 mortgage. That’s a big change.

“The truth is that the market is stabilizing.”

In addition to the changes with LLPAs, another thing to know about our housing market is that there’s still a huge lack of inventory. Therefore, the market cannot crash with the lack of supply. If that were to happen, we would have to see significant changes in our economy with something like unemployment. Something drastic would have to happen, so take that misconception out of your mind.

Also, most listings are getting multiple offers, waived inspections, and nonrefundable earnest money. The spring market is here and buying power is up since rates aren’t as volatile. We’re still in a seller’s market, but it’s now more affordable for buyers, especially with the change in the LLPAs.

Overall, know that it’s a fantastic time to sell. We’ve been busy this year, there’s still a huge lack of inventory, and rates are stabilizing. Therefore, if you’re thinking about making a real estate move, know that we can help. We’re here to be your market experts, so if you need additional information, reach out. You can call or email us anytime and we would love to help.